Introduction

Predicting online food delivery demand has become one of the biggest challenges for brands, restaurants, and delivery platforms operating in competitive urban markets. As cities expand and customer preferences shift rapidly, businesses need structured data-driven methods to understand demand patterns at a hyperlocal level.

That’s where city clustering becomes a powerful technique. By grouping localities with similar order behavior, cuisine preferences, pricing sensitivity, and delivery density, businesses can optimize their decisions with greater accuracy. In this guide, we explore how to extract foodpanda data for demand prediction and how city clustering strategies help organizations identify trends, allocate resources, and stay competitive in an ever-evolving digital food ecosystem.

This blog breaks down key datasets, advanced scraping methods, customer insight extraction, and the role of real-time data in enhancing prediction accuracy. With a detailed breakdown of 2020–2025 trends, you’ll gain a clear understanding of what to collect, how to structure your findings, and how to use them to build powerful demand-forecasting models tailored for the online food delivery industry.

Market Dynamics for Restaurant & Delivery Patterns

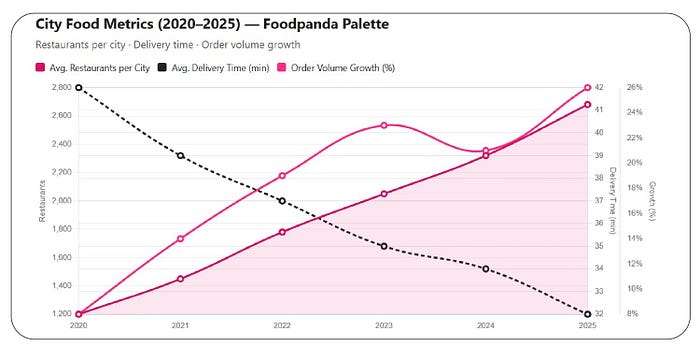

Understanding restaurant and delivery patterns across different regions is essential for building meaningful demand-forecasting models. Urban consumption behavior is deeply influenced by cuisine trends, working hours, festive cycles, and local delivery availability. To conduct accurate analysis, businesses often need to Extract foodpanda restaurant and delivery data that provides insights into restaurant density, peak time orders, delivery shortages, and customer wait-time patterns. Clustering cities based on these metrics helps identify regions with similar order characteristics. For example, highly urbanized clusters show higher late-night orders, whereas residential zones show peak activity between 6–9 PM. Analyzing delivery supply-demand imbalance across clusters helps restaurants optimize staffing and delivery partners. Below is an illustrative dataset summarizing restaurant activity trends from 2020–2025 that businesses use for demand prediction:

This trend clearly shows steady restaurant expansion and reduced delivery times-key factors to consider when clustering cities for more precise demand forecasting.

Understanding Behavioral Shifts Across Customer Segments

Customer behavior is a core component of accurate demand prediction, and understanding shifting preferences requires structured data monitoring. Businesses often need to Scrape Foodpanda Customer Insights For Data Analysis to understand what influences ordering frequency, cuisine popularity, cart values, and reorder cycles. These insights help categorize cities based on customer lifestyle patterns, spending capacity, and ordering triggers. For instance, metropolitan clusters exhibit high demand for fast food and international cuisines, while tier-2 cities lean more toward regional and value-driven meals. Customer sentiment derived from reviews also reveals pain points such as inconsistent delivery or limited restaurant choices in certain zones. By tracking changes from 2020 to 2025, brands can identify long-term behavioral cycles. The table below highlights an example of customer-centric data extracted for clustering analysis:

Such insights allow businesses to map customer clusters more effectively and tailor localized marketing campaigns, pricing strategies, and menu recommendations.

Evaluating Location-Based Availability & Pricing Trends

City clustering requires granular evaluation of delivery availability, surge pricing behavior, restaurant pricing variations, and service coverage. Businesses often compile a foodpanda delivery availability and pricing dataset to assess how delivery operations differ between high-density and low-density regions. Availability gaps highlight where delivery partners are insufficient, while pricing patterns reflect market competitiveness. In high-traffic commercial zones, frequent surge pricing indicates consistent demand pressure, whereas residential clusters show more stable pricing throughout the day. Pricing sensitivity helps classify cities into premium, mid-market, and budget segments. Below is a 2020–2025 snapshot illustrating delivery availability and pricing trends used for cluster modeling:

These pricing and availability indicators help forecast peak demand zones and predict where delivery delays or order surges are likely to occur.

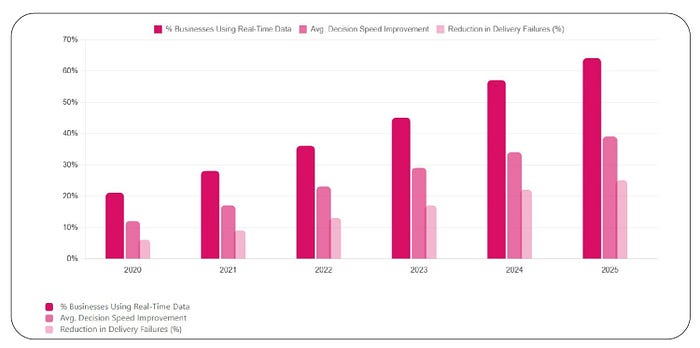

Using Instant Data Streams for Live Decision-Making

Real-time data plays a critical role in predicting consumer demand, especially in fast-changing market environments. Businesses utilize real-time foodpanda data extraction for analytics to access live order spikes, rider availability, delivery time fluctuations, and fresh customer feedback. Unlike static datasets, real-time streams reveal immediate shifts-such as sudden food trends, local events, weather disruptions, and hyperlocal delivery bottlenecks. Clustering cities based on real-time volatility helps classify regions into stable, semi-volatile, and highly dynamic segments. This enables quicker decision-making for surge pricing, inventory restocking, and delivery partner deployment. Between 2020 and 2025, instant data-based decision systems became increasingly prevalent, as shown below:

Real-time clustering makes forecasting more responsive, accurate, and aligned with rapid market shifts.

Tracking Price Movements Across Local Markets

Price fluctuations shape regional demand behavior, affecting everything from user order frequency to average cart value. Businesses aiming for accurate forecasting need to Scrape foodpanda Prices Data and study pricing trends across restaurants, cuisines, and time periods. Price elasticity varies significantly between city clusters: premium clusters tolerate higher price ranges, while value-focused regions respond strongly to offers and discounts. Monitoring changes from 2020 to 2025 reveals how price sensitivity evolved. A structured table capturing these pricing dynamics is provided below:

*Sensitivity score represents customer responsiveness to price changes (higher = more sensitive).

Expanding Beyond Food — Analyzing Q-Commerce Growth

Quick commerce has rapidly emerged as a major growth segment, influencing demand patterns across food and non-food products. Businesses analyze purchase cycles, delivery time expectations, and product assortment by choosing to Extract Quick Commerce Product Data from marketplaces that operate on short delivery windows. Clustering cities based on q-commerce performance reveals patterns in household essentials, snacks, beverages, and OTC product demand. From 2020 to 2025, q-commerce adoption saw exponential growth, which significantly influenced delivery infrastructure planning. Here’s a sample trend comparison:

These insights help businesses create cluster-based strategies for assortment planning, delivery fleet allocation, and real-time inventory management.

Why Choose Product Data Scrape?

Product Data Scrape specializes in building intelligent scraping solutions designed to support high-quality predictive analytics for the food delivery and q-commerce industries. Whether you need Foodpanda Quick Commerce Scraper solutions, city-level segmentation, or detailed operational metrics, our tools deliver structured datasets with high accuracy. We also help businesses extract foodpanda data for demand prediction, enabling them to uncover meaningful insights and enhance marketing, pricing, and logistics strategies with confidence.

Conclusion

City clustering has proven to be one of the most effective analytical strategies for forecasting demand in the online food delivery industry. With access to the right datasets-restaurants, customers, pricing, availability, and q-commerce-businesses can build tailored prediction models for every region. When you extract foodpanda data for demand prediction through automated, scalable scraping systems, you gain the competitive advantage needed to make accurate decisions. Ready to get started? Contact Product Data Scrape today to power your data-driven forecasting.

FAQs

1. Why is city clustering important for demand forecasting?

City clustering groups regions with similar behavior patterns, allowing businesses to predict demand more accurately. Instead of analyzing entire cities as a whole, clustering breaks them into manageable segments where buying behavior, delivery density, and pricing trends align. This approach results in better resource allocation, improved marketing targeting, and higher forecasting accuracy.

2. What types of Foodpanda data are useful for demand prediction?

Useful datasets include restaurant availability, customer ordering patterns, delivery times, menu pricing, surge events, and q-commerce product details. These combined metrics help identify when, where, and why demand rises. Structured datasets provide the foundational insights needed for building machine learning models that forecast real-world scenarios across different city clusters.

3. Can businesses rely on real-time data for improving demand forecasting?

Yes. Real-time data helps teams react instantly to order spikes, weather disruptions, holidays, and operational issues. When integrated with city clustering, real-time metrics allow brands to update predictions dynamically. This reduces delivery delays and enables smarter surge pricing, making operations more efficient while improving customer satisfaction.

4. How often should Foodpanda datasets be updated for accurate forecasting?

For high-demand urban markets, daily or hourly updates are recommended. Customer preferences and delivery conditions change rapidly, especially during holidays, weekends, and major events. Updated datasets ensure the forecasting model remains relevant, accurate, and aligned with real-time market behavior. For smaller regions, weekly updates may be sufficient.

5. How does Product Data Scrape support large-scale datasets?

Product Data Scrape builds automated pipelines capable of extracting millions of data points across multiple regions. Our systems support scalable crawling, structured formatting, and cluster-ready segmentation. This ensures businesses receive clean, real-time, and actionable datasets for forecasting, operational planning, pricing analysis, and cluster-based decision-making.

Originally published at https://www.productdatascrape.com.

Comments

Post a Comment