Introduction

The alcohol industry is undergoing a massive digital transformation. With the rise of on-demand delivery apps, customers across the USA and UK can now order wine, beer, and spirits with just a few taps on their phones. This trend has fueled unprecedented growth in the global alcohol eCommerce market, projected to exceed $42 billion by 2025. Businesses, researchers, and investors no longer rely solely on traditional reports; instead, they tap into scrape liquor delivery app data in the USA and UK to access real-time, large-scale insights.

For instance, USA liquor delivery data for market research reveals important patterns around customer demographics, purchasing cycles, and seasonal demand spikes. In contrast, when businesses extract liquor delivery trends from apps in UK, they uncover unique insights about local consumer behavior, including demand for low-alcohol beverages and shifts toward premium spirits.

The ability to scrape accurate data is no longer a luxury-it’s a necessity for staying competitive. In this blog, we’ll explore six powerful ways liquor delivery datasets solve business problems, supported by sample stats and trends from 2020 to 2025. By the end, you’ll understand why Product Data Scrape is the go-to partner for businesses seeking accurate, actionable alcohol industry intelligence.

Understanding Market Growth Through Data

The global alcohol delivery sector has grown at double-digit rates every year since 2020. Businesses that fail to track these changes risk losing market share. By scraping apps, organizations can evaluate growth trends, detect market shifts, and align strategies accordingly.

For instance, UK liquor delivery data for pricing and demand analysis shows how increased home consumption during lockdowns fueled demand for craft beers, while 2022 saw a spike in gin and premium whiskey. Meanwhile, in the USA, analyze pricing models in USA liquor delivery services highlights how aggressive discounting by new entrants disrupted established players.

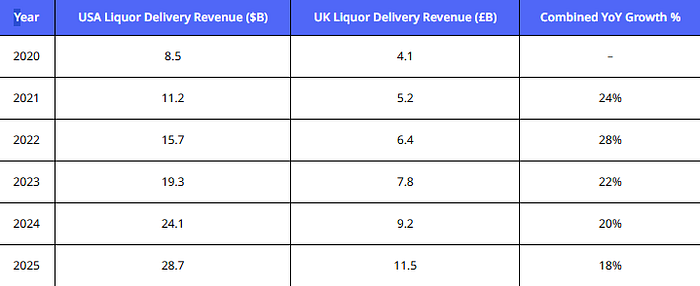

Market Growth Data (2020–2025)

This steady growth shows why businesses are investing in liquor delivery data scraping services . Retailers gain visibility into sales velocity, delivery performance, and emerging categories. Investors use growth stats to evaluate opportunities. Analysts benchmark cross-border performance, while startups validate market entry strategies.

By choosing to scrape liquor delivery app data in the USA and UK, organizations gain a 360-degree view of growth dynamics. The numbers not only highlight consumer demand but also reveal supply chain challenges, such as delivery delays and rising logistics costs. This granular visibility empowers businesses to pivot strategies quickly, ensuring competitiveness in fast-moving markets.

Extracting Order Patterns and Consumer Behavior

Consumer behavior insights are invaluable for shaping campaigns and promotions. The ability to extract order patterns from UK’s alcohol delivery apps reveals details about buying times, seasonal peaks, and preferred categories. For instance, in London, Friday evenings alone account for nearly one-third of weekly liquor orders. In Manchester, gin orders rose 21% in 2023, coinciding with new craft distillery launches.

In the USA, whiskey saw a 19% YoY rise in premium orders, while low-carb beer recorded double-digit growth. These insights are captured only when businesses choose to scrape liquor delivery app data in the USA and UK at scale.

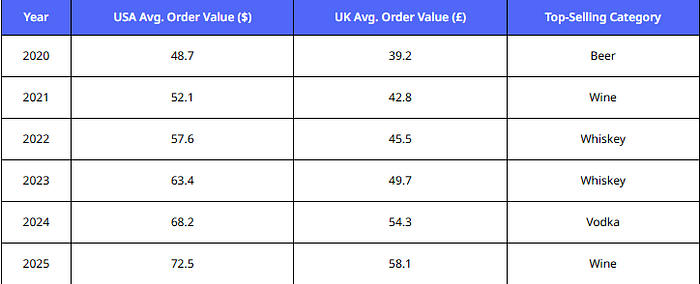

Sample Order Behavior Data (2020–2025)

Insights like these support market research datasets for alcohol delivery, enabling businesses to predict demand and tailor offerings. Imagine pushing a vodka promotion during New Year’s week in London, or launching a whiskey subscription service in New York-data makes these strategies possible.

Patterns also reveal behavioral differences. UK consumers lean toward seasonal experiments, while US buyers show stronger loyalty to established brands. Businesses that adapt campaigns accordingly consistently outperform competitors.

In short, scraping order behavior data equips retailers and distributors with actionable intelligence, ensuring they meet customer expectations at the right time and with the right product.

Leveraging Pricing & Competitive Intelligence

Pricing is one of the most decisive factors influencing customer retention. A difference of even 5% can redirect thousands of orders to a competitor. By choosing to extract alcohol & liquor price data, businesses maintain competitive alignment while protecting profit margins.

In the USA, cart abandonment rates reached 41% in 2022 due to higher delivery fees. Meanwhile, in the UK, retailers using dynamic pricing saw a 15% revenue increase between 2021 and 2023. The need to analyze pricing models in USA liquor delivery services and compare them with UK trends ensures global consistency.

Pricing Insights Table (2020–2025)

Such insights prove invaluable for businesses managing margins in competitive markets. They also power product bundles, discounts, and loyalty rewards.

Additionally, businesses can plug into an Alcohol and Liquor Dataset that tracks not just prices but also regional promotions, delivery fees, and cross-brand comparisons. This creates a comprehensive view of the competitive landscape.

Ultimately, pricing intelligence is no longer optional-it’s a strategic requirement. By leveraging accurate datasets, businesses can identify gaps, monitor competitor strategies, and make informed decisions that maximize both sales and customer loyalty.

Brand-Specific Data Insights

Beyond general market analysis, brands benefit from highly specific datasets. For example, TotalWine Data Scraping Solutions help businesses monitor product catalogs, track discount cycles, and benchmark pricing across regions. This ensures brand competitiveness and prevents pricing mismatches across markets.

In Australia, companies use extract FirstChoiceLiquor.au website data and extract DanMurphys.au website data to uncover localized insights. These datasets highlight SKU variations, seasonal promotions, and delivery performance unique to the Australian market.

For global retailers, comparing USA, UK, and Australian data enables a comprehensive, multinational strategy. For instance, if vodka sells at a 10% premium in the USA but underperforms in the UK, retailers can rebalance stock accordingly.

Brand-specific scraping also supports negotiations with suppliers. By showing price discrepancies across regions, businesses gain leverage in contract discussions. Moreover, historical brand datasets help predict which SKUs are likely to succeed in new markets.

This granular level of insight is possible only when businesses decide to scrape liquor delivery app data in the USA and UK while expanding their scope to include global players.

Market Research Applications

Investors and analysts rely heavily on accurate datasets to evaluate opportunities. Liquor delivery data scraping services empower them with validated intelligence, reducing risks and guiding high-stakes decisions.

For example, companies that extract liquor delivery trends from apps in UK notice a steady demand for low-alcohol beers and hard seltzers-a trend projected to grow 18% annually. Meanwhile, USA liquor delivery data for market research indicates subscription-based models gaining traction, with recurring orders projected to reach 25% of total sales by 2025.

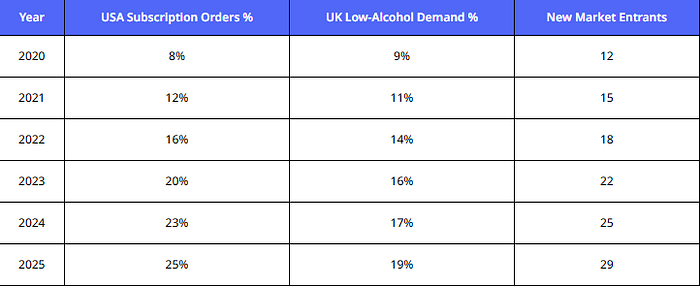

Research Insights Table (2020–2025)

By integrating market research datasets for alcohol delivery, consultants and entrepreneurs can validate product launches, estimate ROI, and benchmark competitors.

This reduces uncertainty in highly competitive sectors, ensuring businesses position themselves strategically and profitably.

Turning Data into Actionable Insights

Scraping data is only half the battle-the real value lies in interpretation. Businesses equipped with an Alcohol and Liquor Dataset can segment customers, predict trends, and personalize campaigns.

For example, during holidays, predictive analytics reveal surges in champagne orders, while economic downturns highlight a pivot toward budget-friendly beers. Such foresight enables retailers to optimize inventory and marketing campaigns proactively.

Actionable insights also include cross-selling strategies. If order patterns show whiskey buyers often add cigars or snacks, apps can recommend bundles, boosting average order value.

Data can also reveal untapped opportunities. Suppose extract order patterns from UK’s alcohol delivery apps shows rising demand for craft cider. Retailers can introduce targeted promotions before competitors catch on.

When integrated with BI dashboards, datasets from liquor delivery data scraping services turn into powerful decision-making tools. Businesses no longer just react-they anticipate.

This transformation ensures companies stay resilient in volatile markets, maximizing growth while minimizing risks.

Why Choose Product Data Scrape?

When it comes to scraping large-scale alcohol delivery data, accuracy and compliance are paramount. Product Data Scrape delivers both. With a proven track record of handling 5M+ records at 95% accuracy, the company is a trusted partner for global retailers, consultants, and analysts.

From order behavior to pricing models, Product Data Scrape provides tailored datasets that integrate directly with business intelligence tools. Clients benefit from real-time updates, dedicated support, and customizable scraping services.

Whether you need insights into consumer trends, pricing intelligence, or competitor benchmarks, Product Data Scrape ensures you have the data to make informed, confident decisions.

Conclusion

The liquor delivery industry in the USA and UK is more dynamic than ever, creating both challenges and opportunities. To thrive, businesses need more than assumptions-they need hard data.

By choosing to scrape liquor delivery app data in the USA and UK, companies unlock a world of insights, from pricing to demand analysis. From USA liquor delivery data for market research to extract liquor delivery trends from apps in UK, the potential applications are vast.

With Product Data Scrape, you gain access to high-quality, accurate, and actionable datasets that fuel smarter decisions. Don’t just follow market shifts-predict and capitalize on them.

Contact Product Data Scrape today to access 5M+ liquor delivery records at 95% accuracy and turn data into growth.

Originally published at https://www.productdatascrape.com.

Comments

Post a Comment